Defining an Effective Carbon Market

What EXACTLY IS a carbon tax?

A carbon tax is aimed at putting a price on carbon dioxide, as well as other GHGs; and effectively lowering emissions from fossil fuel-intensive industries. The carbon tax itself can be a fee on the production, distribution, use of fossil fuels; and the use of fossil fuel-based energy for industries.

Governments set a price per ton on carbon, and then that translates into a tax on oil, coal, and natural gas. This ultimately means higher prices for the end-use consumer for things like gas and electricity due to higher costs for production and distribution of fossil fuels in the case of top-down industry taxes.

A carbon tax is a levy on the following:

- fossil fuel power plants (directly),

- oil refineries (directly),

- industries and/ or fossil fuel-intensive companies (directly);

- and potentially, consumers (indirectly) that use fossil fuels are responsible for generating greenhouse gas emissions (GHGs) in the process.

Carbon-intensive industries that could be in carbon tax systems include: fossil fuel power plants (always in carbon tax systems), and/ or industries and companies such as fossil fuel-intensive product manufacturing companies, and/ or cement and steel manufacturing, and/or transportation sectors that rely on fossil fuel energy.

Purpose of a carbon tax

An indirect consequence of carbon taxes may ultimately be higher prices for energy and gasoline/ diesel. The relationship between a carbon tax and higher energy prices is arbitrary. It's up to the fossil fuel company subject to the carbon tax whether to raise prices for the end-use consumer or take financial losses as a result of the tax.

Alternatively, companies may choose to use more renewable energy and energy efficiency measures to lower CO2 output; and thus lower the applicable carbon tax. Incentivizing companies to increase their use of clean energy technologies is the major objective of a carbon tax. A carbon tax creates the financial incentive to use technology to lower emissions and thus any applicable carbon tax or to switch to renewable energy and avoid the tax altogether.

A carbon tax puts a price on carbon in a given country for the cost to humanity and the planet of the use of fossil fuels (damage to the public health, damage to the environment, from fossil fuel combustion - negative externalities, also known as the social cost of carbon). GHGs other than carbon dioxide can also be included in carbon tax systems (however, carbon dioxide remains the most prevalent GHG included in carbon taxes worldwide).

European Carbon Taxes

The following is a brief insight into carbon taxes in Europe, which is where most carbon taxes in the world currently are (as opposed to the more widely globally adopted emission trading systems - see Putting a Price on Carbon for more information)>>>

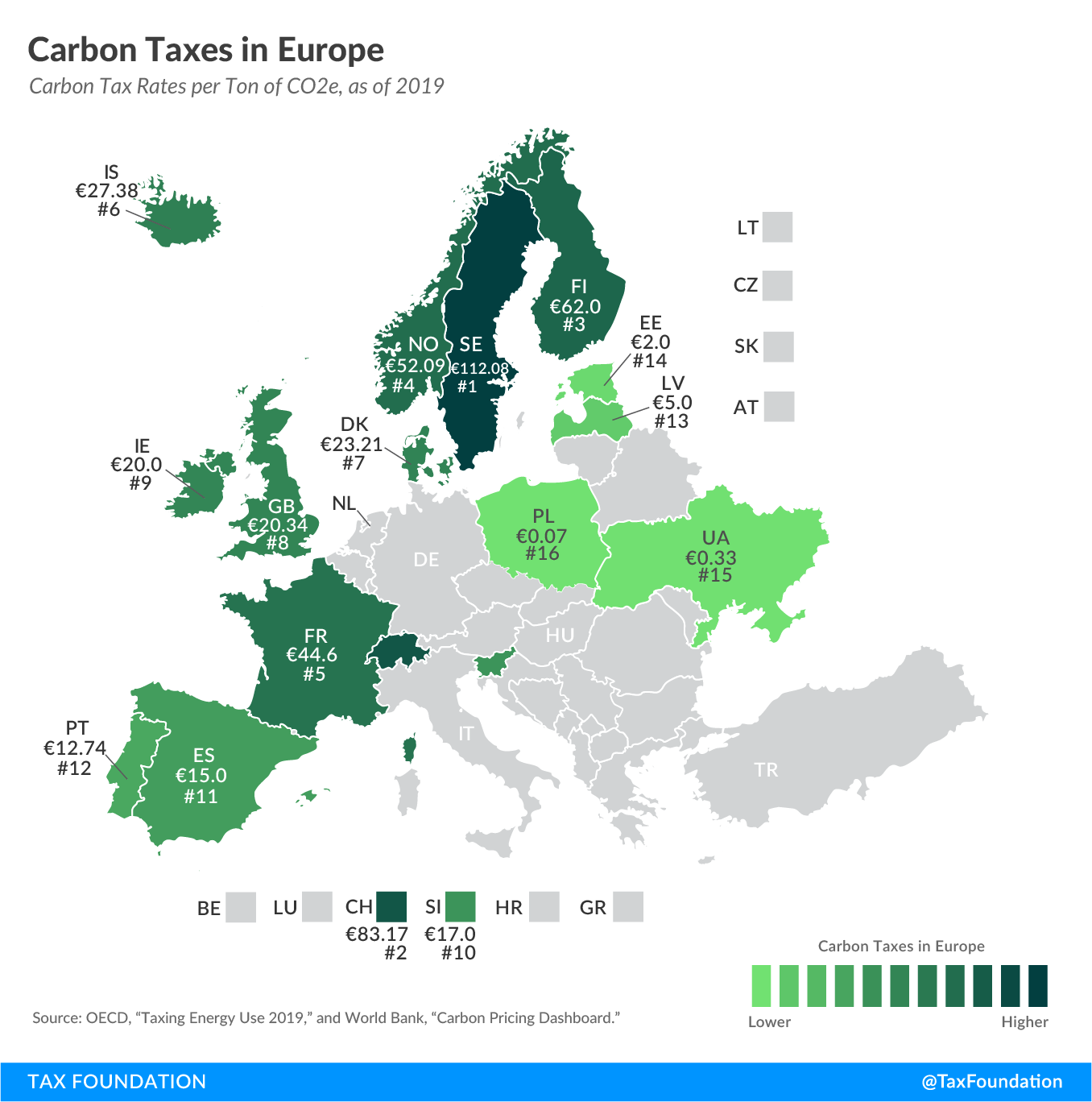

In recent years, several countries have taken measures to reduce carbon emissions using environmental regulations, emissions trading systems (ETS), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax. Since then, 15 European countries have followed, implementing carbon taxes that range from less than €1 per ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

Sweden levies the highest carbon tax rate at €112.08 (US$ 132.17) per ton of carbon emissions, followed by Switzerland (€83.17, $98.08) and Finland (€62.00, $73.11). You’ll find the lowest carbon tax rates in Poland (€0.07, $0.08), Ukraine (€0.33, $0.39), and Estonia (€2.00, $2.36).

Carbon taxes can be levied on different types of greenhouse gases, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. The scope of each country’s carbon tax differs, resulting in varying shares of greenhouse gas emissions covered by the tax.

Negative Externalities

Negative externalities, in the case of fossil fuel production and use, are the costs of damage to the environment and public health. Fossil fuels carry significant costs beyond the purchase price of the energy and goods produced from oil, gas, and coal. These negative externalities show up as costs in healthcare, environmental clean-up, as well as incalculable costs of significant damages to public health and the environment.

A clear example of the negative externalities of fossil fuels is the cost to public health and the environment of methane leaks from gas power plants. Another example is the costs of coal pollution to public health and the environment. The true cost of negative externalities of fossil fuel combustion cannot be tabulated in exact terms, for it’s the estimated accumulated cost of -

- damage to the environment,

- climate change,

- damage to human health,

- other costs stemming from the use of fossil fuels (such as costs to public health systems)

Carbon taxes are a way for governments to enforce the true cost of carbon pollution. This is done by charging polluting fossil fuel industries an appropriate fee to account for the actual costs borne by their activities. At present, industries are subject to a carbon tax for their Scope 1 emissions (directly) and Scope 2 emissions (indirectly). Assessing the actual cost of Scope 3 emissions, or trying to charge end-users a carbon tax is problematic and rarely conceived of or legislated. Definitions of Scope 1-3 emissions are below:

- Scope 1 emissions (direct use of polluting fossil fuel energy, fuel combustion on-site, fuel combustion company vehicles

fugitive emissions) - Scope 2 emission (indirect electricity generated and purchased in the production of the fossil fuel products, indirect use of energy [heat, steam, etc...] in the production process)

- Scope 3 emissions (all other emissions in the value chain and carbon footprint of the fossil fuel product, purchased goods and services, business travel, employee commuting, waste disposal, use of sold products, transportation and distribution (up and downstream), investments, leased assets, and franchises)

- Gaining worldwide consideration and implementation are carbon border taxes, which charge companies based on the carbon footprint of the fossil fuel-intensive product being exported to the country enforcing the carbon border tax

Positive effects of carbon taxes on the reduction of GHGs from industries

Businesses and utilities who face a carbon tax then have the incentive to invest more in energy efficiency, renewable energy, and other GHG-reducing technologies (such as carbon capture); to try and lower their applicable carbon taxes. Another option would be for companies facing a carbon tax to maintain the market price for their goods and services set prior to implementation of the tax and absorb the cost of the tax.

Yet another option, and along with companies' making an effort to produce cleaner energy, this is a commonly implemented option; higher prices due to carbon taxes may result in higher prices to end-consumers (the carbon tax simply gets passed on to the consumer, allowing the company to keep profits from lowering).

Individual consumers then have the incentive to reduce consumption of fossil fuels and fossil fuel-intensive products subject to carbon taxes, switch to electric vehicles and renewable energy (thus avoiding higher prices stemming from the carbon tax), and increase their energy efficiency habits. Revenue from carbon taxes can, in some cases, go to energy efficiency measures, sustainable transportation, renewable energy, and other clean energy projects.

The revenue from carbon taxes can also simply be distributed or refunded to the public through tax rebates or payroll tax reductions (revenue-neutral carbon taxes). With revenue-neutral carbon taxes, higher energy prices may be offset by tax dividend refunds, or tax cuts, of roughly similar value as the higher prices for consumers.

Carbon tax revenue can be distributed, at least in part (if not completely), as:

- personal income or business income tax cuts,

- tax rebates,

- tax credits,

- payroll tax cuts,

- a "carbon dividend" in the form of a monthly, quarterly, bi-annual, or annual refund,

- or carbon tax revenue can be used to reduce taxes for the public and businesses in other sectors of the national economy

Carbon tax revenue is sometimes both invested in clean energy projects and given back to the public as refunds/ tax credits. However, currently, carbon taxes are primarily used worldwide to help fund renewable energy, energy efficiency, and other public goods programs for the region implementing the carbon tax. Notable exemptions exist, where carbon tax revenue is redistributed to the population, in one of the forms described above- such as throughout provinces in Canada.

Pros and Cons of Carbon Taxes

The principle of mitigating negative externalities (such as the damage caused by fossil fuels), and having the relative costs of pollution paid for, is the primary purpose of the carbon tax. Who bears the ultimate burden of the tax is a hypothetical question that has a couple of answers.

Unless the carbon tax is specifically aimed at consumers, businesses that produce and distribute fossil fuels should at least consider bearing the brunt of the tax. However, in practice, individuals ultimately end up paying more for gas and higher prices on their utility bills, among other fossil fuel-related goods and services, from companies that haven't already fully embraced renewable energy.

A carbon tax is enacted with the underlying goal of lowering GHGs. Low carbon measures such as sustainable public transportation, energy efficiency, and technologies such as carbon capture and storage, become even greater alternatives when a carbon tax is enacted; as fossil fuel-intensive industries are penalized. One other benefit of a carbon tax, besides the revenue generated for the public good, and the incentives to reduce fossil fuel consumption and increase energy efficiency; is the increased attractiveness of the cost of renewable energy.

Denmark, Finland, Ireland, the Netherlands, Norway, Sweden, Switzerland, Canada, Chile, and the UK, (among other nations, countries, and states), have all successfully implemented a partial carbon tax on some goods and services, while not all being able to implement a broad, universal carbon tax. Generally, reports of lower greenhouse gas emissions follow the passage of a carbon tax (to the tune of 2-3% annually in most cases this decade). The province of British Columbia, in Canada, has reported drops of around 5% annually of greenhouse gas emissions due to its aggressive carbon tax policies.

Please also see: