Three immediate ways to boost renewable energy development - feed-in tariffs, net metering, and RPS

Feed-in tariffs for renewable energy (REFITs) are created to provide guaranteed grid access and long-term contracts for renewable energy producers. REFITs also set compensation over a set period of time for excess renewable energy produced by property owners.

Countries around the world are working to incentivize their investments in renewable energy; one of the primary means to increase public investment in renewable energy is for national, state, and local governments to mandate feed-in tariffs for renewable energy. Net metering and renewable portfolio standards (RPS) are also effective means by which to accelerate the energy transition to clean and renewable energy (see below explanations of both).

Compensation Forms for Feed-In Tariffs

The ultimate goal of feed-in tariffs is to provide compensation to renewable energy producers. Also, feed-in tariffs have the effect of working to encourage further investments in renewable energy technology, and to incentivize home and business owners to incorporate renewable energy sources into their properties.

Renewable energy feed-in-tariffs (REFITs) are paid by wholesale energy purchasers (grid operators or energy market operators, utilities, or government bodies), to producers/ distributors of RE. Payment of REFITS are made by parties representing utilities, grid operators, or governmental entities that have often entered into power purchase agreements (PPAs) with renewable energy producers. A PPA sets a minimum amount of renewable energy that must be purchased for use in the energy grid in a specified area. A PPA is often a long-term contract (15-25 years).

Compensation in REFIT programs is typically set to retail price for most renewable energy sources, except for solar. As the number of participants in a REFIT program in a location increases, the feed-in tariff rate slowly lowers to the retail rate. Power purchase agreements with monetary rewards are often slightly lower than retail, except in cases of solar power. Because solar energy is often produced during peak electricity use times, reimbursement is usually slightly higher than retail.

Feed-in tariffs are priced per kilowatt-hour, so the tariff itself can seem pretty low by itself (for ex. if a REFIT was priced at $0.05 per KWh), before multiplying the tariff by thousands of KWh of energy used in tallying the actual final tariff amount. REFITs can be applied to different sizes and scales of distributed energy resource (DER) projects; or REFITs can be applied to grid-scale RE projects.

DER projects in REFIT programs include everything from net-metered rooftop solar PV and solar PV microgrids, to waste-to-energy generators, to other DER, to microgrids or municipal grids; such as wind energy. So for example, a solar PV microgrid priced at a $.20 per KWh REFIT, would have a $.20 per KWh REFIT surcharge added to the final cost of electricity generated (although REFITs vary in amount and scale from this example).

DER projects in REFIT programs include everything from net-metered rooftop solar PV and solar PV microgrids, to waste-to-energy generators, to other DER, to microgrids or municipal grids; such as wind energy. So for example, a solar PV microgrid priced at a $.20 per KWh REFIT, would have a $.20 per KWh REFIT surcharge added to the final cost of electricity generated (although REFITs vary in amount and scale from this example).

Here is a brief summation of the REFIT concept:

Feed-in tariffs (FIT) are fixed electricity prices that are paid to renewable energy (RE) producers for each unit of energy produced and injected into the electricity grid. The payment of the FIT is guaranteed for a certain period of time that is often related to the economic lifetime of the respective RE project (usually between 15-25 years). Another possibility is to calculate a fixed maximum amount of full-load hours of RE electricity production for which the FIT will be paid. FIT are usually paid by electricity grid, system or market operators, often in the context of Power purchasing agreements (PPA).

Currently, in most RE support schemes, the level of FIT is determined on the basis of a calculation of the levelized cost of electricity (LCOE) produced from RE. This allows the RE investor to recover the different costs (capital, O&M, fuel, financing) while realizing a return on his investment that depends on the assumed financing costs. In some cases, FIT have been calculated on the basis of avoided costs (e.g. environmental externalities). FROM - energypedia.info/Feed-in_Tariffs

Global Usage of Feed-in Tariffs for Renewable Energy

Over 80 countries mandate some type of renewable energy feed-in tariffs; and a few states in the United States mandate feed-in-tariffs or similar programs. Countries mandating renewable energy feed-in tariffs include Spain, France, Germany, Israel, Italy, and the United Kingdom. Eligible renewable energy sources for REFITs include solar, wind, geothermal, hydroelectric, biomass, and waste-to-energy; however, the type of renewable energy compensated varies by country.

For example, solar is the primary renewable resource eligible for feed-in tariffs in the U.S. (for the limited feed-in tariffs a few states the U.S. does have), but Spain has feed-in tariffs for nearly all forms of renewable energy; and the UK offers these incentives for solar, hydroelectric, wind, and aerobic digestion/ biogas. Perhaps the most well-known example of successful feed-in tariffs is the example of REFITs introduced during the solar industry boom in Germany even after REFIT programs had been implemented throughout the country in 2000, as part of Germany's Renewable Energy Sources Act.

Programs utilizing feed-in tariffs are rapidly increasing around the world for electricity produced using all types of renewable energy sources. However, instead of feed-in tariffs, often considered a direct subsidy, the United States has most often simply gone with tax credits (tax rebates, tax incentives for renewables and clean, zero-emission energy developments in the industry, and power generation sectors).

Over 20 states in the United States also have Renewable Portfolio Standards (RPS - see below); to work synergistically with REFITS or investment tax credits (ITCs) for renewables. The use of REFITs, tax credits, and RPS, as a mix to financially incentivize RE, is explained in this article from Inside Climate News-

"Feed-in tariffs like this have long been the primary tool for financing renewable energy projects in Europe, and they are a reason Spain and Germany have become world leaders in wind and solar. Advocates say the system is simpler, more effective and less expensive than traditional U.S. incentives for renewable energy, which are an often byzantine mix of tax incentives [ITCs], rebates, state mandates and utility programs [RPS).

So what's standing in the way of wider adoption in the United States?

It's politics...Currently, most renewable energy incentives in the United States come in the form of tax credits, which are only valuable to companies with large enough profits that want to lower their tax burden...

Paul Gipe, a leading advocate for renewable feed-in tariffs, said the policies are too important to let utility companies stand in the way.

"It's all about whether you want to do it or not. That's it. Why do we care what the investor-owned utilities think?" Gipe said. "Why does any policymaker – an elected official who's charged with representing the public's interest and future generations' interests – why should their primary concern be what the electric utility thinks? Do you want it or not?"

Net Metering and REFITs

An interesting tangential theme to the REFIT story is net metering programs, which are programs modeled on REFIT systems; and which allow residential and small business property owners to receive compensation for excess energy renewable resources (mostly solar PV) their properties produce. Net metering offers credits based on excess electricity produced by on-site renewable energy sources, mostly in the form of solar rooftop PV or PV arrays on residential, commercial, and business properties.

Net metering programs also allow properties to utilize electricity from the grid when necessary. However, in net metering programs, electric bills are reduced and credits based on excess energy generated by on-site RE systems sold back to the grid are credited to electricity bills.

Power purchase agreements offer cashback to the producer of renewable energy based on the excess energy generated in REFIT systems; similar to how private businesses and residences are compensated for excess renewable energy generation in net metering systems. Compensation in net metering programs in the form of credits for private renewable energy producers (including homeowners and small businesses with rooftop solar PV panels or on-site PV arrays) is typically set above retail price for electricity; thus encouraging more properties to adopt renewable energy sources.

REFIT programs and net metering programs, varying slightly by country, have been heralded by renewable energy supporters as the best means of increasing the use of renewable energy on a city-by-city, property-by-property basis. Relatively simplistic, and very effective, feed-in tariffs and net metering programs are helping to pave the way for a worldwide transition away from traditional, fossil fuel-based energy production to renewable energy.

Renewable Portfolio Standards (RPS)

All types of renewable energy production can be mandated by a renewable portfolio standard (RPS); when RPS legislation is passed and maintained, in a state in the United States (similar laws are present in other countries by other names, such as the Renewables Obligation in the UK, which is complementary to the REFIT program in the UK).

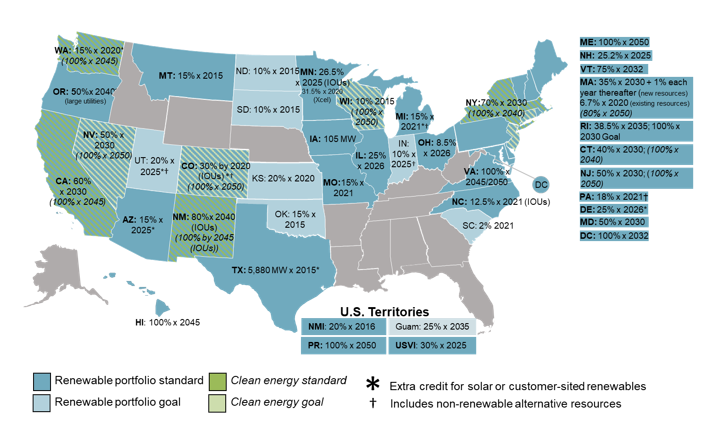

RPS has been mandated by state legislatures, and is still in effect in the state, in 29 states in the United States. States may mandate only some types of renewable energy in their RPS, or instead may choose to mandate clean energy standards (which include energy generation sources such as fossil fuel generation with carbon capture and storage, and/ or nuclear energy). Often states mandate a hybrid mix of these goals.

Some states have very ambitious clean and renewable standards, and are leaders in the worldwide energy transition to clean energy. For example, California has a target of 80% clean energy by 2030, with a corresponding goal of 100% electricity from renewables for the state by 2045. Here is a snapshot of some ambitious 100% clean and renewable energy goals among states in the U.S.:

States, Districts, and Territories Committed to 100% Renewable Energy

- California California is the second state in the U.S. to set a state-wide goal of 100% renewable electricity by 2045.

- Hawaii Hawaii is the first state in the U.S. to set a state-wide goal of 100% renewable electricity by 2045.

- Maine In June 2019, Maine adopted a new Renewable Portfolio Standard, committing the state to 80 percent renewable energy by 2030 and 100 percent by 2050.

- Nevada Nevada SB358 was passed unanimously by both the Senate and Assembly in 2019, setting the goal of 50% renewable electricity statewide by 2030, & 100% clean energy by 2050.

- New Mexico In March 2019, New Mexico adopted the Energy Transition Act, which requires electricity generation in the state to be 80% renewable by 2040, and 100% carbon-free by 2045.

- New York On July 18, 2019, Governor Andrew Cuomo signed into law the Climate Leadership and Community Protection Act, which mandates New York reduce 85% greenhouse gas emissions economy-wide by 2050; sources 70% of electricity from renewables, like wind and solar, by 2030; achieves a 100% carbon-free electric sector by 2040; requires 35% of climate adaptation benefit frontline communities through efficiency, renewable energy, jobs programs and more; protects disadvantaged communities by requiring an air quality monitoring program and prohibits carbon offsets for the electric, transportation and building sectors.

- Virginia On March 6, 2020, Virginia's Clean Economy Act passed, mandating the state's utilities transition to 100% clean, renewable energy no later than 2050. The bill promises to make the state a leader in offshore wind and energy storage and includes provisions to cap energy bills for low-income households, alleviating energy burden.

- Washington In 2019, the Washington State legislature passed Senate Bill 5116, which mandates an equitable transition to 100% clean electricity generation for the entire state by 2045.

There remains no federal clean energy policy in the United States; so each state continues to set its own renewable energy and/ or clean energy standards for the given state's energy mix. President Biden's Build Back Better Plan aims for a federal clean energy standard (CES). A CES is less stringent than an RPS, as any clean or low carbon energy source is allowed (including nuclear energy, or fossil fuel with highly efficient carbon capture). Here is a map of states with RPS or CES, (and their corresponding level of ambition. A very high level of ambition for a state is California, striving for 100% clean energy by 2045):

And here is a map of states in the U.S. with mandated (and voluntary) renewable energy feed-in tariffs:

Please also see:

Stabilize GHGs- public policy