Pricing Carbon Worldwide

Carbon Markets & Carbon Taxes

Emissions trading system (ETS), and a carbon tax, are carbon pricing mechanisms that can be mandated by countries, states, provinces, and other administrative locales. Carbon markets refer to places where an ETS is present. The goal of many countries/ states, utilities/ power providers, and industries/ companies in locales with carbon markets is to reduce greenhouse gas emissions (GHGs).

The same goal (reducing GHGs) is true for governments that implement a carbon tax. Another goal of pricing carbon is to encourage research, development & deployment (RD&D) of low emissions technologies and other GHG reduction solutions. Increasingly, the goal in carbon markets is to achieve net zero emissions (often by 2050, or a different future date is sometimes targeted by some countries).

Please see:

The Fight Against Climate Change: Carbon Reduction and Net Zero Targets

Please also see:

Carbon Tax – a levy on pollution whose time has come

Global Carbon Pricing

The world's largest and most successful emissions trading system is the EU ETS - ["The European Commission reckons the price of CO2 [in the EU ETS] in 2030 could be around €85 per tonne..." FROM - euractiv.com/emissions-trading-scheme/analyst-eu-carbon-price-on-track-to-reach-e90-by-2030]

"In recent years, several countries have taken measures to reduce carbon emissions using environmental regulations, emissions trading systems (ETS), and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax. Since then, 16 European countries have followed, implementing carbon taxes that range from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden." FROM - taxfoundation.org/carbon-taxes-in-europe

For reference, below is a map of carbon taxes in Europe from taxfoundation.org>>>

Carbon Cap and Trade/ Emissions Trading Systems (ETS)

Carbon cap and trade systems (synonymous with ETS) are regulatory systems in which countries, provinces, and states, set a limit (a cap) on the amount of GHGs allowed. Unlike a carbon tax, each ton of carbon dioxide (CO2) from industry is not directly taxed in an ETS, but a carbon price is established through carbon auctions (a list of industries commonly included in an ETS is below).

GHGs regulated in cap and trade markets are first and foremost CO2 emissions (and often also other GHGs, otherwise known as CO2 equivalent emissions - CO2e) emitted during power generation from fossil fuel power plants. CO2 emissions from power plants are always in cap and trade systems. Optimally, carbon cap and trade systems will also apply to other carbon-intensive industries and a wide range of CO2e (ideally across multiple economic sectors of national, regional, state, or other administrative locales).

Carbon pricing legislation in which an ETS is implemented is commonly referred to as a carbon cap & trade system in the US. The term also applies to similar carbon market systems in Europe, as well as elsewhere globally where an ETS is legislated in an administrative locale.

[NOTE OF TERMS USED - In this article, we will treat cap and trade systems and ETS as synonymous. Carbon pricing can be implemented just for CO2, or also for CO2e, which represents the number of metric tons of CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas. In this article, we will just use the term "GHGs". GHGs include both CO2 and CO2e.]

Who is subject to carbon pricing?

Carbon-intensive industries that are considered for inclusion in an ETS include one or more of these sectors (these sectors also form the framework of industries subject to a carbon tax):

- fossil fuel power plants & oil/ gas refineries (CO2 emissions from power plants are always included in carbon pricing systems)

- fossil fuel-intensive product manufacturing companies

- petrochemical manufacturing companies

- cement and steel manufacturing industries

- transportation sectors that rely heavily on fossil fuels (such as long-haul shipping - including heavy trucking, ocean freight shipping, & aviation)

Benefits of carbon pricing

Carbon pricing (ETS and/ or carbon tax) has a few purposes that benefit society, the economy, and the environment generally. Carbon pricing is used for the public good, and the good of the planet, by encouraging sustainability measures. Such measures include renewable energy projects, energy efficiency projects, low-carbon energy projects, and forestry/ conservation projects (these are measures that are implemented through carbon permits/ carbon offsets in an ETS). A wide range of measures that are encouraged by the implementation of carbon pricing is discussed below.

An ETS and/ or a carbon tax effectively make using dirty fossil fuels more expensive, thereby encouraging utilities and industries to reduce consumption of fossil fuels and increase renewable energy, low-carbon energy, and energy efficiency measures. An ETS and/ or a carbon tax also effectively make renewable energy an even more attractive option than fossil fuels economically (adding to the economic benefits of renewable energy). The primary function of carbon pricing is to lower GHGs, fight climate change, and reduce pollution from the combustion of fossil fuels. Therefore, carbon markets ultimately benefit all of humanity and the planet.

Carbon permits

Carbon permits are usually priced at 1 metric ton CO2 emissions/ equivalent GHGs (CO2e) metric ton per $1, €1, or a similar monetary unit in the country regulating the ETS. Purchasing carbon permits allows fossil fuel-intensive companies to emit CO2 up to the cap. Carbon permits are auctioned off in carbon credit auctions.

Carbon permits can be substituted by a fossil fuel-intensive company by the purchase of carbon offsets (see below). A carbon offset is valued for each 1 ton of emissions offset but represents a sustainability project (see below for details) that is deemed worthy by the governmental regulations/ compliance agency in charge of the ETS.

Industry compliance with ETS/ how carbon markets work

In an ETS that does use auctions; auctions for carbon permits work to functionally put a price on carbon (one carbon permit is usually = to 1 metric ton of CO2 or CO2e). ETS with auctions are much more effective than systems where carbon credits are just '"grandfathered in". The cost of carbon permits (otherwise known as carbon allowances, or GHG emission permits), effectively forms the price of carbon in these systems.

Governments may sometimes choose to "grandfather in" GHG allowances (essentially give away permits based on past GHG production/ reduction progress). Companies with a stockpile of carbon permits have historically often been able to keep their carbon permits for future use in trading (although this practice is now being curtailed), or for their own emission allowances.

The option used more often currently in ETS is to auction permits off in carbon credit auctions (such as the World Bank Climate Auction Program).

As carbon permits are auctioned off, a price on carbon is functionally established.

For companies that run over their emissions limits and don’t cover their allowances, a substantial fine is often imposed. Carbon cap and trade systems are usually designed to adjust the cap annually; limiting and regulating more CO2 emissions/ GHGs gradually, increasing the cap on GHGs for utilities and industries in the ETS, and increasing the effective price on carbon.

Carbon Offsets

Carbon offsets are a vital part of making ETS work; allowing companies to invest in international sustainability projects in order to fulfill their GHG reduction obligations. There are trades that offset GHG emissions in cap & trade systems. Examples of such trades include trades for credits with companies that invest in RD&D of renewable energy, energy efficiency, green building, sustainable transit, and other low-carbon energy projects.

ETS also commonly include credits for investments in sustainable agriculture, agroforestry, and other forestry/ conservation projects. Sanctioned carbon offsets that meet regulatory compliance standards, in many administrative locations, also include investment in reforesting or projects that work to limit deforestation, trades with companies that have livestock projects that incorporate sustainable practices, or with companies that invest in other carbon sequestration measures.

To make ETS even more effective, it’s useful to have offsets allowed for trades with companies that use a range of low-carbon green energy technologies. Examples of such low-carbon technologies include integrated gasification combined cycle (IGCC), anaerobic digestion (AD), and combined heat and power (CHP). Green and low-carbon energy projects that reduce GHGs also increasingly include carbon capture & storage (CCS).

Carbon offsets represent a larger global market than just ETS. Carbon offsets can be purchased by individuals, non-profit organizations, and private businesses of every size, from small businesses to large international companies, and even governments.

Basically, any individual or entity may purchase carbon offsets in order to lower their net carbon footprint and to support sustainability efforts worldwide. In many cases, carbon offsets are purchased by international companies in industries running polluting factories, using carbon-intensive fuel for energy, and manufacturing fossil fuel-intensive products.

This often includes companies that themselves are involved in deforestation. Carbon offsets help balance out global GHGs and other environmental degradation. For instance, carbon offsets increase the sustainability efforts of companies responsible for damage to the environment, deforestation, degradation of ecosystems, and GHG emissions.

Carbon offsets for reforestation, planting trees, and other conservation projects provide fossil fuel-intensive companies with "nature-based" offsetting solutions. Trees, plants, and wilderness ecosystems sequester carbon.

Ideally, carbon offsets should be valued and calibrated to truly offset the company's emissions, as reflected in the company's investment in the offsets. "Nature-based" carbon offsets act as land carbon sinks, optimally sequestering carbon to the degree the company purchasing the offsets is emitting carbon - but this depends on how the "nature-based" offsets are valued.

Forestry conservation carbon offset projects, sustainable and regenerative agriculture projects, and other ecological conservation projects are also known as carbon dioxide removal (CDR). Other examples of CDR projects are direct air capture and bioenergy with carbon capture and sequestration (BECCS).

Renewable energy and energy efficiency projects have the potential to directly lower emissions of the company/ industry in question, if the investments are made for the company itself. Otherwise, the carbon offsets are valued as creating "avoided emissions" by investing in a 3rd party company's renewable energy and energy efficiency projects. Nature-based CDR projects are often in this "avoided emissions" category as well. 'Avoided emissions" are often a dubious form of carbon offsets, as the data to support avoided emissions projects can be easily manipulated or simply made up.

Low and zero green energy technologies and CDR offset projects should be high quality enough to be valued highly, and have an appropriately higher price based on the high quality of the commodity (the carbon offset).

The number of carbon offsets required for a company to purchase in an ETS, should be carefully made proportional to the amount of GHGs released by the company involved in the ETS; and should also be measured by the deforestation that a company commits, and the subsequent effect of that behavior by the company on the environment.

However, as of now, most ETS around the world only use the amount GHGs released by companies, not deforestation, as a metric to assess a companies' responsibility for purchasing carbon offsets.

For some companies, it might make more financial sense and be more cost-effective to make the effort to reduce emissions through emission saving and energy efficiency technologies and/ or expanded use of renewable energy; and then sell their permits to companies that are over their GHG limit.

However, usually, most companies tend to buy carbon permits if it’s cheaper to buy them than to try to lower emissions. Carbon permits can be invested in by businesses, industries, or even the public in some regions, via a carbon futures market.

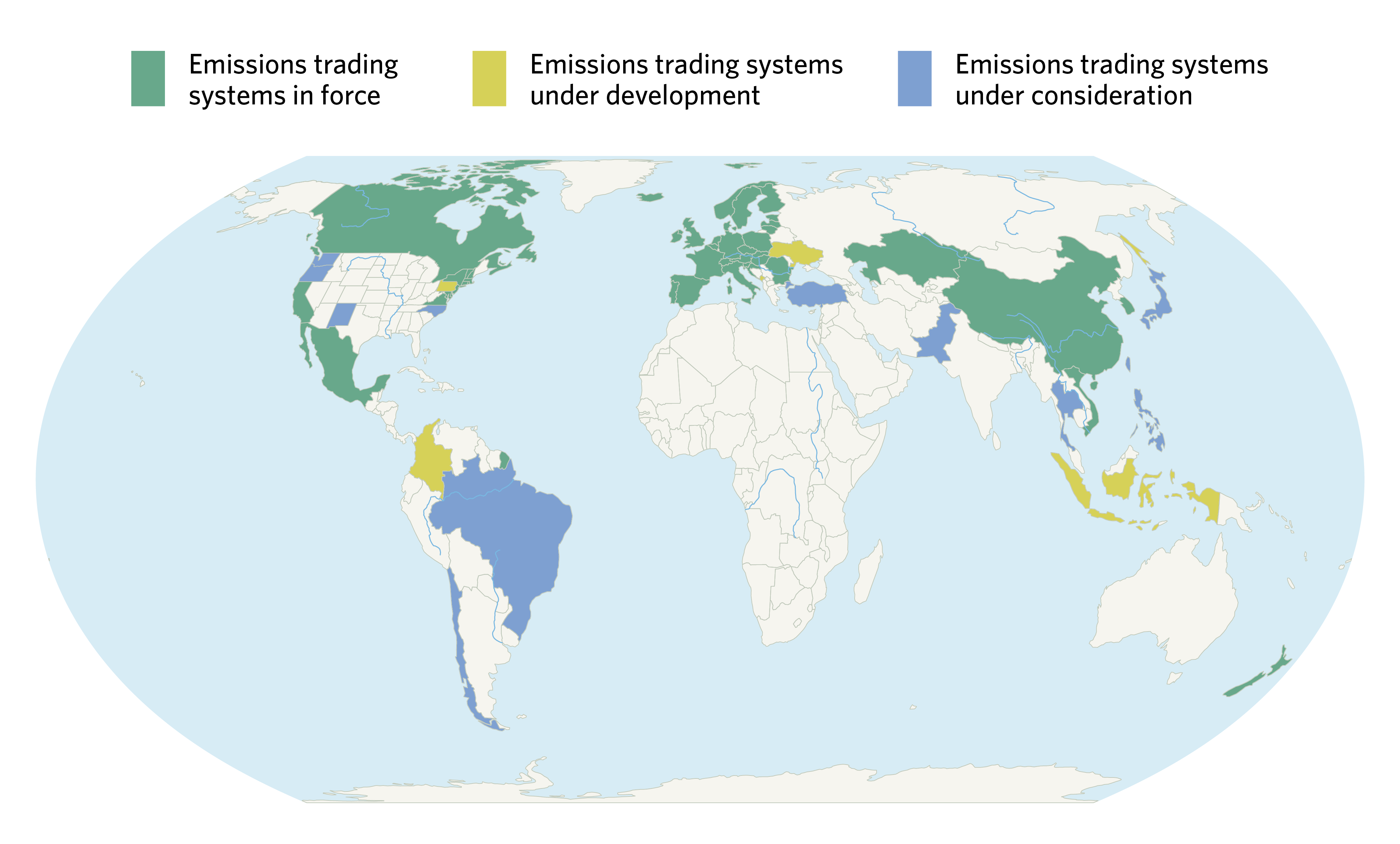

Carbon pricing throughout the world

Carbon pricing, either as carbon cap and trade systems or a carbon tax, is in effect in over 40 countries, as well as over 25 states/ provinces/ cities globally. The largest market for cap and trade is in the EU with the European Union Emissions Trading System (EU ETS). The EU ETS covers more than 11,000 power plants and industrial stations in over 30 countries; as well as some European airlines.

The EU ETS has successfully put an effective price on carbon (the carbon price of the EU ETS started out low, but carbon prices in the ETS are growing steadily higher). Since the EU ETS began in 2005, Europe has watched GHG emissions fall by a few percentage points annually. The EU continues to make efforts to reduce pollution by progressively ramping up the effective carbon price of the EU ETS (up to around €55+/ ton CO2 in 2021). As of May 2021, the price per ton in the EU ETS had reached €50 and is projected to almost double again this decade.

The nine-state agreement in the U.S. northeast, the Regional Greenhouse Gas Initiative (RGGI) is another major carbon cap and trade trading pact, and is, at least partially, based on the pioneering EU program. Carbon allowances have been auctioned to power companies in RGGI states (RGGI only covers the electricity sector). Although the carbon price in RGGI is relatively low (at only several dollars per ton CO2), RGGI has collected well over $1 billion from carbon cap and trade programs. This revenue has been invested in energy efficiency, renewable energy, and other clean energy programs.

Since carbon cap and trade has started in the U.S. northeast, GHG emissions in this region have steadily dropped. Like the EU, this is in part due to investment in clean energy technologies, but also because some companies in the U.S. northeast have switched from dirtier fossil fuels like coal to cleaner natural gas generators in power plants, or to renewable energy.

Unlike RGGI, California's cap-and-trade covers multiple industries, not just energy generation, and while still a relatively low carbon price (relative to the EU ETS), the cost per ton of CO2 is about double that of RGGI. California's cap-and-trade was passed by state-wide legislation in 2006; RGGI was launched in 2009. Since 2007, the California cap-and-trade system has partnered with various Canadian provinces; most notably Quebec, which continues to be California's most reliable partner in the Western Climate Initiative (as this regional ETS is known).

ETS in the US have low average carbon prices (below $10/ ton CO2 in RGGI, and below $20 in California), so while these ETS have been effective in getting fossil fuel power plants to invest more in clean energy; the more effective carbon prices in Northern Europe are considerably higher.

Summaries and links to European and American carbon cap and trade markets:

EU ETS:

ec.europa.eu/clima/policies/ets

The U.S. Northeast region - Regional Greenhouse Gas Initiative (RGGI):

bostonglobe.com/business/carbon-caps-help-northeast-economy-report-says

STORY - "Cap & Trade Shows Its Economic Muscle in the Northeast, $1.3B in 3 Years (Regional Greenhouse Gas Initiative offers blueprint to all states)" - By Naveena Sadasivam, InsideClimate News- insideclimatenews.org/cap-trade-shows-economic-muscle-northeast-13-billion-RGGI-clean-power-plan

California Cap-and-Trade/ WCI:

edf.org/californias-cap-and-trade-program-step-by-step.pdf

and California has an agreement with Quebec, Canada - establishing a connected carbon market between them, the Western Climate Initiative (WCI):

environnement.gouv.qc.ca/changements/carbone/WCI

Clean, low- & zero-carbon technologies like renewable energy, energy efficiency, CCS, IGCC, CHP, and AD; have all grown in popularity throughout Europe (and worldwide), in part, because of the rising price of carbon. In addition to the EU ETS, many European countries have independently legislated national carbon pricing systems.

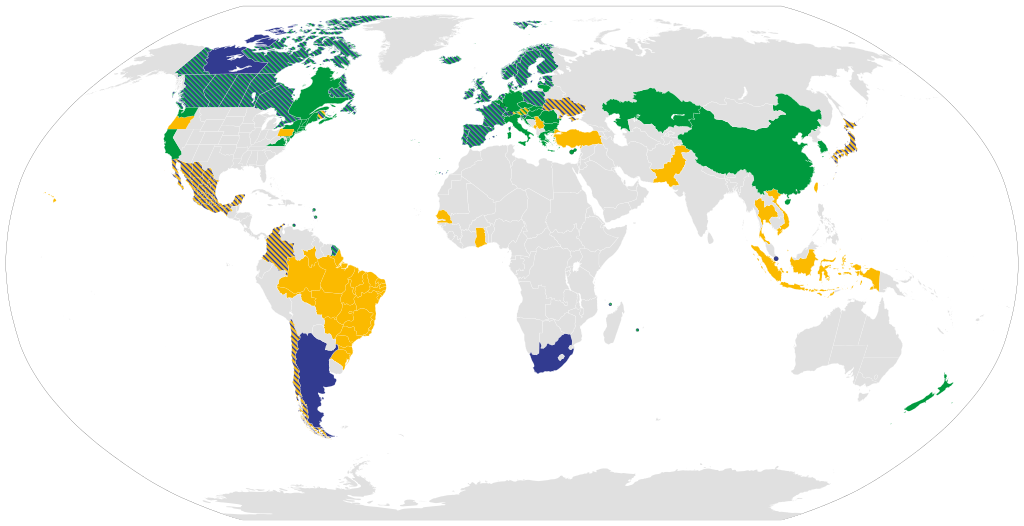

Here’s a helpful map of carbon pricing for various around the globe (carbon pricing is usually based on the basic per-unit price of 1 metric ton of CO2):

All countries, regions, and administrative locales, deal with carbon pricing differently. Most locations that have carbon pricing have cap and trade for fossil fuel-intensive industrial sectors and always price fossil fuel power plants.

The U.K., France, Switzerland, and the Scandinavian countries Norway, Sweden, and Finland, have legislated both carbon tax and cap and trade programs in their individual countries. These countries all put a carbon price on fossil fuel power plants, but each country has included different fossil fuel-intensive industries in their unique carbon pricing systems; and none have a simple, national carbon price for all GHG emitting industries.

Switzerland, Finland, and Sweden's carbon pricing systems represent high enough prices per metric ton of CO2 to make a significant difference; and represent the type of carbon pricing needed to make a substantial impact on industries to stabilize GHGs.

South Korea has cap and trade for heavy industry, power, waste, transportation, and building sectors. China has six provinces testing out cap and trade, and along with South Korea, represent very large carbon markets (with just those 6 provinces China is a large market, the entire country represents the single largest potential carbon market, by far). Worldwide, over 40 national governments have mandated a price on carbon.

Although some G20 nations have not yet passed official carbon pricing systems, many do have market-based carbon pricing signals, such as gasoline taxes, that end up being less effective than actual carbon pricing systems that put a price on GHGs. In G20 countries that have actually passed nationwide carbon pricing legislation, the average carbon price in these countries is too low to be effective. Here's a brief snippet from an independent global economic analytics firm that specializes in sustainable investments>>>

"G20 Carbon Price Signals Insufficient to Reach Paris Agreement Goals

A new IHS Markit report highlights shortcomings in the G20 approach to carbon pricing and other market mechanisms. The world's largest economies have made market-based mechanisms a central feature of their climate change mitigation strategies. Carbon pricing, subsidy management, and fiscal incentives are being used by the Group of 20 (G20) countries to varying degrees, but the current implementation of these mechanisms is unlikely to result in sufficient emission reductions to realize the Paris Agreement objectives.

- Carbon pricing mechanisms, including carbon taxes and emission trading systems, are falling well short of levels needed to achieve low-emission cases. It has been suggested that the global economy-wide carbon price needed to achieve emission reduction targets consistent with the Paris Agreement is between US$40 and US$80 per metric ton of carbon dioxide (CO2) by 2020. By contrast, the average carbon price across the G20 today is US$16 per metric ton of CO2." FROM - ihsmarkit.com/Info/0918/g20-carbon-price